.jpg)

A number of measures were announced in the Autumn Budget 2025 which will impact individuals with investment income.

In this article we consider these changes, and how they could impact you going forward.

Taxation of dividends

From 6th April 2026, the rate of tax charged on dividend income will increase by 2% for both basic rate, and higher rate taxpayers. The rate of tax on dividends within the additional rate tax bracket remains unchanged.

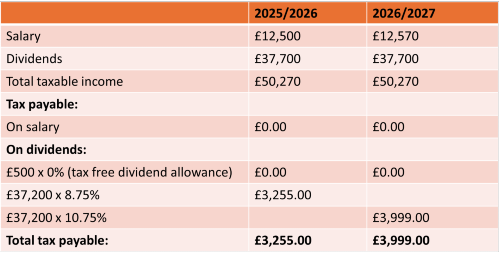

The tax-free dividend allowance remains unchanged at £500 per annum. How this could affect you is demonstrated below:

Wilson is the sole director/shareholder of a limited company. Historically, he has received a salary from the company equal to his personal allowance, with dividends voted to him to utilise his basic rate tax band.

It was previously announced that the personal allowance and basic rate tax band will remain unchanged in the 2026/2027 tax year.

Therefore, in this scenario, because of the changes announced, Wilson will be £744 per annum worse off.

The impact is greater when dividends voted fall within the higher rate tax band.

Taxation of interest

A number of measures were also announced which will increase the tax payable on interest received. These measures are expected to take effect from 6th April 2027.

Firstly, for individuals aged under 65, the cash ISA savings limit will be capped at £12,000 (down from £20,000), although this remains unchanged for individuals aged 65 and over.

It was also announced that the income tax rates used to calculate the tax liability arising from interest will increase by 2%, from 20% to 22% for basic rate taxpayers, 40% to 42% for higher rate taxpayers, and from 45% to 47% for additional rate taxpayers.

The tax-free personal savings allowance remains frozen at £1,000 for basic rate taxpayers, £500 for higher rate taxpayers and £0 for additional rate taxpayers.

Please get in touch if you would like to discuss how these changes could impact on your personal tax affairs going forward.

The information provided in this blog is for general informational purposes only and should not be considered professional advice. As far as we are aware, the content is accurate at time of publication. Torgersens assumes no responsibility for errors or omissions in the content or for any actions taken based on the information provided.