Most countries adopt a tax year which runs to the calendar year end, or, if not, at least to a month end. Of all the countries that use a traditional Christian calendar, the UK is the only one which deviates from that norm, using 5th April. Have you ever wondered why?

The Calendar Guys – Julius and Gregory

The 365 days in the annual calendar is meant to match up with the Solar Year. The latter, however, is slightly longer at around 365 ¼ days (365 days 5 hours 48 minutes and 46 seconds to be precise). This is why we have a leap year every 4 years, as an attempt to catch up with that ¼ day difference. The Egyptians were the first to come up with this mechanism and it was later adopted by the Romans under the reign of Julius Caesar. In 46BC the Julian Calendar was born which added an additional day every 4th year. As a measure, it wasn’t too bad, with the average calendar year being 11 minutes and 14 seconds longer than the Solar Year.

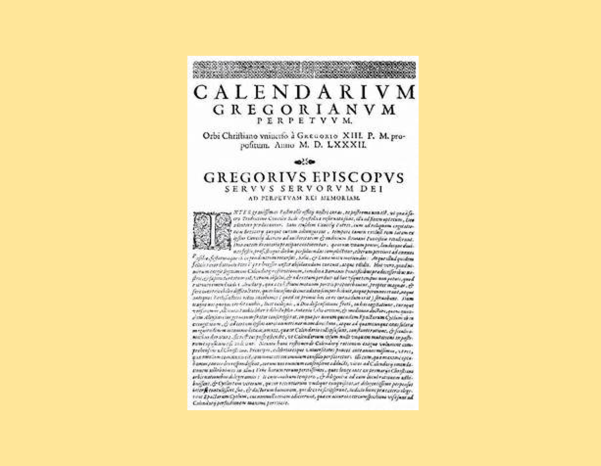

However, all of those 11 minutes and 14 seconds begin to mount up. After 128 years, the calendar gains a whole extra day. You might ask yourself: Does this really matter? Well, to Pope Gregory XIII it mattered a great deal as Easter was falling further and further behind the Spring equinox with each passing year. In fact by 1582, it was some 10 days out of whack. In that year, Gregory recovered the lost days by advancing the calendar by 10 days and at the same time brought in a new calendar – the Gregorian calendar – which corrected the errors in the Julian calendar by only adding a leap day in the century year, if the first two digits were also divisible by 4. So for example, 1600 had a leap day in both calendars; 1700 did not have a leap day in the Gregorian calendar (whereas it did in the Julian calendar). This change also meant that the annual calendar was now only 26 seconds longer than the Solar Year.

The adoption of the Gregorian Calendar was decreed by Papal Bull and applied across the Catholic world. Protestants, fearing a Papist plot, continued to use the Julian Calendar, which was now some 10 days adrift of the Gregorian. This threw up some seemingly amazing feats of time travel: William of Orange, who acceded to the English throne in 1689, managed to set sail from the Netherlands on 11th November 1688 and arrive in England on 5th November 1688!

Over the decades, other Protestant countries started to adopt the Gregorian Calendar, and by 1752, Britain and its colonies had decided to follow suit. As we had taken another leap year in 1700, we were now 11 days adrift of most of Europe, so the calendar was advanced in September 1752; people fell asleep on the evening of 2nd September and woke up on the morning of the 14th September and we were now in synch with the rest of Europe.

A New Year’s Revolution

Was everybody happy with this change? There were reports of riots in some places, with rioters demanding the return of the 11 days stolen from them. Landlords were certainly not happy with the loss of 11 days’ rent and the Board of Stamps and Taxes (a forerunner of the Inland Revenue) were not too enamoured of the loss of 11 days’ worth of taxes because of the change. Rather than lose that income, the government took the step of advancing the tax year by 11 days to compensate.

Since 1155, the legal year in England had begun on 25th March (Lady Day) meaning that the year end fell on 24th March each year. The extension of 11 days advanced the year end to 4th April. A missed Julian leap day in 1800 meant that the government felt obliged to extend the year end an additional day, to 5th April, in that year. A further Julian leap day due in 1900 was skipped and 5th April has remained the tax year ever since.

Is this the end of the story?

In the first part of this blog, I mentioned that the Gregorian Calendar is 26 seconds longer than the Solar Year. All of those 26 seconds begin to mount up; in the 435 years since 1582, the difference has grown to 3 hours 8 minutes and 30 seconds. By the year 4905, the Gregorian Calendar will be a full day ahead of the Solar Year, which might necessitate a further adjustment.

I guess, by that time, I’ll be past caring!

The information provided in this blog is for general informational purposes only and should not be considered professional advice. As far as we are aware, the content is accurate at time of publication. Torgersens assumes no responsibility for errors or omissions in the content or for any actions taken based on the information provided.

.jpg)

.jpg)